Selling puts on margin

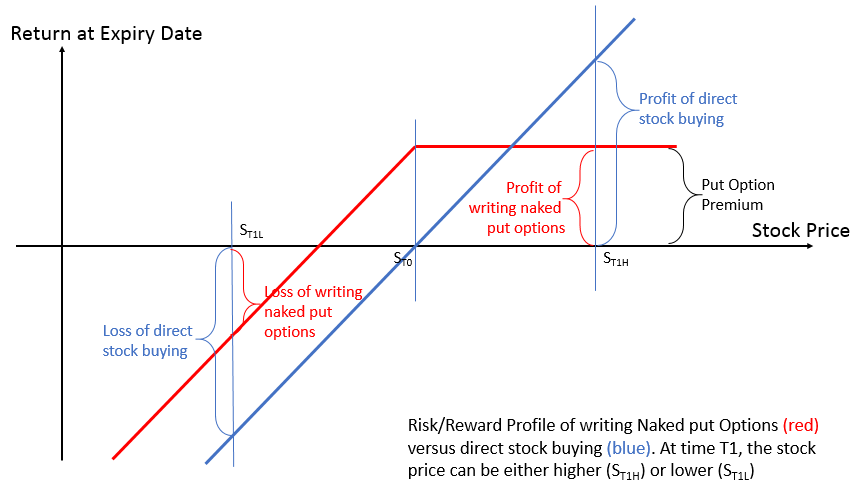

Short puts may be used as an alternative to placing buy limit orders. 32 rows Margin Requirements Applies to Stock Index Options A minimum available equity of 2000 is required for option strategies eg spreads and 5000 for uncovered options eg.

Short Put Option Strategy Explained The Options Bro

Make sure not to get exercised or.

. Typically sell 30-40 delta for 14-30 dte. Ad Turn Every Friday Into An Extra Payday Selling And Trading Puts. Before you can sell those new shares for cash Monday rolls around and KO opens at 42share.

Rates subject to change. Cash secured puts use options collateral which you do not pay interest on with Robinhood so they are effectively free to sell using margin. Applies when selling uncovered puts in a margin account The margin requirement for an uncovered put is the greatest of the following calculations times the number of contracts times.

Buying options is typically a Level I clearance since it doesnt require margin but selling naked puts may require Level II clearances and a margin account. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. I have margin on my account but I target.

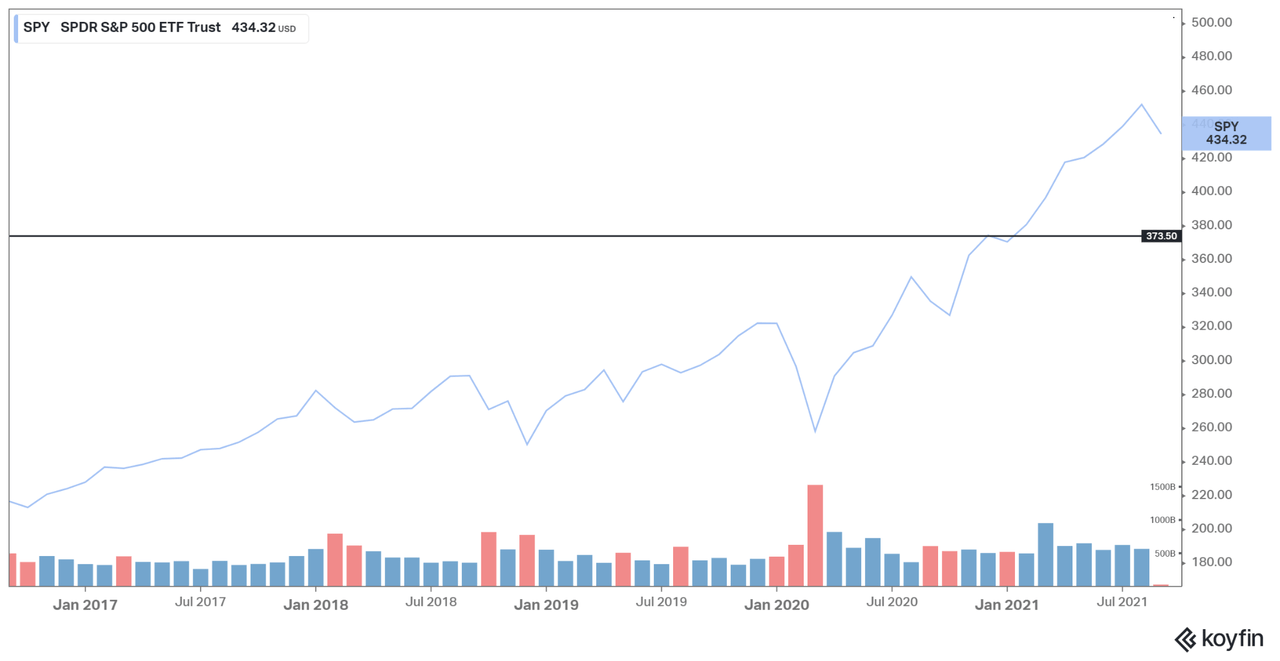

Margin rates as low as 283. You could place a GTC limit order to buy 200 shares at 90 and wait to see if you buy the shares. Whats The DifferenceA lot actuallyIn th.

Free Education No Hidden Fees and 247 Support. You would like to buy 200 shares of stock XYZ if it drops to 90. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Level III and IV. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Selling cash covered puts is a strategy where the market deposits money into your account over and over until you finally get put the stock you already wanted to buy.

I sell all my puts using buying power. Open an Account Now. I target no more than 50 of my account in total put obligation.

YHOO current market price 4970. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. If youre selling put options you need to decide if youre going to use a cash account or a margin account.

Its a great way to. Open an Account Now. Or you could sell two XYZ 90.

Margin rates as low as 283. Trader wants to own 100 shares of YHOO if price goes down to 49. Part of the reason its at 42 a share is because lots of people like you who were selling naked.

A Superior Option for Options Trading. Rates subject to change.

How Do Leap Options Work Leap Option Trading Strategy Why Is Owning Leap Call Options Better The Trading Strategies Options Trading Strategies Option Trading

Most Profitable Option Trading Strategy Selling Puts Covered Calls Collar What Is The Most Pr Options Trading Strategies Option Trading Trading Strategies

United States Puts Idaho Chipmaker At The Center Of Its Fight With China Cnn Micron Technology Tech Stocks Stock Market

Printing Money Selling Puts Seeking Alpha

Covered Put Explained Online Option Trading Guide

Pin On Movie Clips

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

Short Put Definition

Short Put Naked Uncovered Put Strategies The Options Playbook

Trading Calls Puts Robinhood

The Right Way To Think About Selling Puts For Income Seeking Alpha

Option Strategies Writing Puts On Falling Prices Is Controversial But It Works Seeking Alpha

Option Strategies Don T Buy And Sell Shares Write Options Instead Seeking Alpha

When Should You Roll A Short Put Option Up How Do You Roll Out Short Options Put Option Stock Options Trading Option Trading

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Put Option Vs Call Option When To Sell

When Should You Roll A Short Put Option Up How Do You Roll Out Short Options Put Option Stock Options Trading Option Trading

Short Put Strategy Guide Setup Entry Adjustments Exit

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference